ChatGPT的火爆,成为大模型的AlphaGo时刻,也许更像iPhone发布开启移动互联网,网景浏览器之于互联网。这已经影响了各大公司的战略方向:微软因为富有远见地与OpenAI结盟处于最好的位置,受威胁最大的Alphabet已经拉响红色警报,百度也在紧锣密鼓在搜索引擎里加入相关功能……

Meta呢?今天的财报电话上,扎克伯格提及最多的关键词,是AI。很明显,他已经认识到AI而非元宇宙才是当前的战略重点,会对整个产业产生巨大影响。

当然,他对元宇宙的措辞还是比较委婉的:

我想介绍一下我们的优先领域的最新情况。 自去年以来,我们的优先事项没有改变。推动我们路线图发展的两大技术浪潮是当前的 AI 和从长远来看的元宇宙(AI today and over the longer term the metaverse)。

请注意,“当前”和“更长期”这两个修饰词。此外,他也认识到元宇宙体验最初可能不是在VR/AR设备上,而还是通过移动App。

而CFO Susan Li(她是目前几个科技巨头里位置最高的华人,而且很年轻,2005年斯坦福大学本科毕业)在后面的提问环节说得更明确:未来公司的资金主要用于AI如何更好的支持几大应用,以及对应所需的数据中心算力资源。

对AI,小扎怎么看呢?不仅已经给公司带来巨大商业价值:AI推荐系统(发现引擎)是业务增长的第一功臣,也是广告业务的基础(小扎之前猛搞元宇宙而不是猛抄抖音,是明显走了弯路啊);2023年效率年,提升效率的重要举措之一,就是部署AI提高工程师的效率;而且对未来更加重要:

AI 是我们发现引擎和广告业务的基础——我们还认为它将在我们的应用程序中催生许多新产品和其他转型。生成式 AI 是一个非常令人兴奋的新领域,有许多不同的应用,我对 Meta 的目标之一是在我们的研究基础上,除了我们在推荐 AI 方面的领先工作之外,成为生成式 AI 的领导者。

嗯,生成式AI(generative AI)是未来。

扎克伯格在后面的提问中进一步阐述了自己对大模型支持的生成式AI的看法:

我认为这是一个非常令人兴奋的领域。 我的意思是,我想说今年关注的两个最大主题,一个是效率,然后在新产品领域将是生成式AI相关的工作。I'd say the two biggest themes that focused on for this year and one is efficiency and then the new product area is going to be the generative AI work.

我们各个产品都有很多不同的工作流,但所有工作流都要用到一些新技术,尤其是用于生成图像和视频、化身和 3D 资产以及所有各种不同东西的大型语言模型和扩散模型。我们正在开发这些技术,并且从长远来看,这些技术将真正使创作者能够在App中更高效、更有创造力,而且运行许多不同帐户。

所以我认为这里有一些非常令人兴奋的东西。 我想需要小心一些,不要太超前于它的发展了。 所以我想你会看到我们今年推出了许多不同的东西,我们会讨论它们,我们会分享它们的最新进展。 我确实希望这个领域会快速发展。我想我们会学到很多关于什么有效什么无效的知识。 很多东西都很昂贵,对吧,生成图像或视频或聊天互动。

我们正在谈论的这些东西,还非常早期。 因此,这里最有趣的挑战之一就是我们如何扩展它并使它的工作更有效率,这样我们就可以将它带给更大的用户群。 但我认为一旦我们成功了,将会有许多非常令人兴奋的应用场景。 我知道目前这是一个有点虚的答案,但我认为我们将能够在未来几个月内分享更多细节。

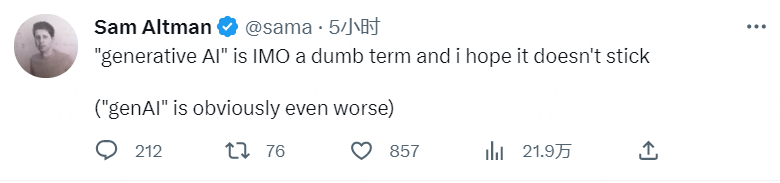

虽然生成式AI这个说法被OpenAI CEO Sam Altman批评了:

但小扎对技术趋势的认知还是基本靠谱的,能及时自我纠错,从短期内很难落地的元宇宙转向AI,善莫大焉。

关心产业发展趋势和企业战略的同学,小扎在Meta财报电话会议上的讲话全文值得一读:

2022 was a challenging year, but I think we ended it having made good progress on our main priorities and setting ourselves up to deliver better results this year as long as we keep pushing on efficiency. I said last quarter that I thought our product trends look better than most of the commentary out there suggests. I think that's even more the case now. We reach more than 3.7 billion people monthly across our family of apps. On Facebook, we now reach 2 billion daily actives and almost 3 billion monthly. The number of people daily using Facebook, Instagram and WhatsApp is the highest it's ever been.

2022 年是充满挑战的一年,但我认为我们在主要优先事项上取得了良好进展,并为今年取得更好的成绩做好了准备,只要我们继续提高效率。 我在上个季度说过,我认为我们的产品趋势看起来比大多数评论所暗示的要好。 我认为现在更是如此。 我们的应用程序系列每月覆盖超过 37 亿人。 在 Facebook 上,我们现在每天有 20 亿活跃用户,每月有近 30 亿活跃用户。 每天使用 Facebook、Instagram 和 WhatsApp 的人数创历史新高。

Before getting into our product priorities, I want to discuss my management theme for 2023, which is the "year of efficiency". We closed last year with some difficult layoffs and restructuring some teams. When we did this, I said clearly that this was the beginning of our focus on efficiency and not the end. Since then, we've taken some additional steps like working with our infrastructure team on how to deliver our roadmap while spending less on capex. Next, we're working on flattening our org structure and removing some layers of middle management to make decisions faster, as well as deploying AI tools to help our engineers be more productive. As part of this, we’re going to be more proactive about cutting projects that aren't performing or may no longer be as crucial, but my main focus is on increasing the efficiency of how we execute our top priorities.

在进入我们的产品重点之前,我想讨论一下我 2023 年的管理主题,即“效率年”。 我们去年关闭了一些艰难的裁员和重组一些团队。 当我们这样做时,我明确表示,这是我们关注效率的开始,而不是结束。 从那时起,我们采取了一些额外的步骤,比如与我们的基础设施团队合作,研究如何在减少资本支出的同时交付我们的路线图。 接下来,我们正在努力扁平化我们的组织结构并移除一些中间管理层以更快地做出决策,并部署人工智能工具来帮助我们的工程师提高工作效率。 作为其中的一部分,我们将更加积极主动地削减表现不佳或可能不再那么重要的项目,但我的主要重点是提高我们执行首要任务的效率。

I think there's going to be some more that we can do to improve our productivity, speed, and cost structure, and by working on this over a sustained period I think we'll both build a stronger technology company and become more profitable. I am very focused on doing this in a way that helps us build better products, and because of that, even if our business outperforms our goals, this will stay our management theme for the year so I think it’s going to make us a better company. At the same time, I'm also focused on delivering better financial results than what we've reported recently and on meeting the expectation that I outlined last year of delivering compounding earnings growth even while investing aggressively in future technology.

我认为我们可以做更多的事情来提高我们的生产力、速度和成本结构,并且通过在一段持续的时间里努力,我认为我们将建立一个更强大的技术公司并变得更有利可图。 我非常专注于以一种帮助我们打造更好产品的方式来做这件事,正因为如此,即使我们的业务超出了我们的目标,这仍将是我们今年的管理主题,所以我认为这将使我们成为一家更好的公司 . 与此同时,我还专注于提供比我们最近报告的更好的财务业绩,并满足我去年概述的预期,即使在积极投资未来技术的同时实现复合收益增长。

Next, I want to give some updates on our priority areas. Our priorities haven't changed since last year. The two major technological waves driving our roadmap are AI today and over the longer term the metaverse.

接下来,我想介绍一下我们的优先领域的最新情况。 自去年以来,我们的优先事项没有改变。推动我们路线图发展的两大技术浪潮是当今的 AI 和更长期的元宇宙。

First, let's talk about our AI discovery engine. Facebook and Instagram are shifting from being organized solely around people and accounts you follow to increasingly showing more relevant content recommended by our AI systems. This covers every content format -- which is something that makes our services unique -- but we're especially focused on short-form video since Reels is growing so quickly. I'm really proud of our progress here. Reels plays across Facebook and Instagram have more than doubled over the last year, while the social component of people resharing Reels has grown even faster and has more than doubled on both apps in just the last 6 months.

首先,让我们谈谈我们的 AI 发现引擎。Facebook 和 Instagram 正在从仅仅围绕您关注的人和帐户组织起来,越来越多地展示我们的人工智能系统推荐的更多相关内容。这涵盖了所有内容格式——这是我们服务的独特之处——但我们特别关注短视频,因为 Reels 增长如此之快。我为我们在这里取得的进步感到非常自豪。 去年,Reels 在 Facebook 和 Instagram 上的播放量增加了一倍多,而人们转发 Reels 的社交内容增长得更快,仅在过去 6 个月内,这两个应用程序的播放量就增加了一倍多。

The next bottleneck that we're focused on to continue growing Reels is improving monetization efficiency, or the revenue that’s generated per minute of Reels watched. Currently, the monetization efficiency of Reels is much less than feed, so the more that Reels grows, even though it adds engagement to the system overall, it takes some time away from feed and we actually lose money. But people want to see more Reels though, and the key to unlocking that is improving our monetization efficiency so that we can show more Reels without losing increasing amounts of money. We're making progress here, and our monetization efficiency on Facebook has doubled in the past six months. In terms of the revenue headwind, we're still on track to be roughly neutral by the end of this year or maybe early next year, and after that we should be able to profitably grow Reels while keeping up with the demand that we see.

In our broader ads business, we’re continuing to invest in AI and we're seeing our efforts pay off here. In the last quarter, advertisers saw over 20% more conversions than in the year before. And combined with a declining cost per acquisition, this has resulted in higher returns on ad spend.

We continue to be excited about the monetization opportunity with business messaging too. Facebook and Instagram are the first two pillars of our business, and in the next few years we hope to bring messaging online as the next pillar. One way of doing this is click-to-message ads, which is now at a $10 billion run rate.

Paid messaging is the other piece of this. We're earlier here, but we continue to onboard more businesses to the WhatsApp Business Platform, where they can answer customer questions, send updates, and sell directly in chat. For example, AirFrance started using WhatsApp to share boarding passes and other flight information in 22 countries and in 4 languages. Businesses often tell us that more people open their messages and they get better results on WhatsApp than other channels.

AI is the foundation of our discovery engine and our ads business – and we also think it's going to enable many new products and additional transformations within our apps. Generative AI is an extremely exciting new area with so many different applications, and one of my goals for Meta is to build on our research to become a leader in generative AI in addition to our leading work in recommendation AI.

The last area that I want to talk about is the metaverse. We shipped Quest Pro at the end of last year, and I'm really proud of it. It's the first mainstream mixed reality device, and we're setting the standard for the industry with our Meta Reality system. As always, the reason why we're focused on building these platforms is to deliver better social experiences than what's possible today on phones. The value of MR is that you can experience the immersion and presence of VR while still being grounded in the physical world around you. We're already seeing developers build out some impressive new experiences like Nanome for 3D modeling molecules and drug development, Arkio for architects and designers to create interiors, and of course a lot of great games. The MR ecosystem is relatively new, but I think it's going to grow a lot in the next few years. Later this year, we're going to launch our next generation consumer headset, which will feature Meta Reality as well, and I expect that this is going to establish this technology as the baseline for all headsets going forward, and eventually of course for AR glasses as well.

Beyond MR, the broader VR ecosystem continues growing. There are now over 200 apps on our VR devices that have made more than $1 million in revenue.

We're also continuing to make progress with avatars. We just launched avatars on WhatsApp last quarter and more than 100 million people have already created avatars in the app. Of those, about one in five are using their avatar as their WhatsApp profile photo. I thought that was an interesting example of how the Family of Apps and metaverse visions come together. Because even though most of our Reality Labs investment is going towards future computing platforms -- glasses, headsets, and the software to run them -- as the technology develops, most people are going to experience the metaverse for the first time on phones and start building up their digital identities across our apps.

Alright, so those are the areas we're focused on: AI, including our discovery engine, ads, business messaging, and increasingly generative AI, and the future platforms for the metaverse. From an operating perspective, we're focused on efficiency and continuing to streamline the company so we can

execute these priorities as well as possible and build a better company while improving our business performance.As always, I'm grateful to our teams for your work on all of these important areas, and to all of you for being on this journey with us.

为继续发展 Reels,我们关注的下一个瓶颈是提高货币化效率,即每分钟观看 Reels 所产生的收入。目前,Reels 的货币化效率远低于 Feed,因此 Reels 增长得虽然快,增加了整个系统的参与度,但也减少了Feed的时间,我们实际上是在赔钱。但是人们希望看到更多的 Reels,而解锁的关键是提高我们的货币化效率,这样我们就可以展示更多的 Reels 而不会损失更多的钱。 我们正在这方面取得进展,过去六个月我们在 Facebook 上的货币化效率翻了一番。 就收入逆风而言,我们仍有望在今年年底或明年年初大致保持中立,之后我们应该能够在满足我们看到的需求的同时实现盈利增长 Reels。

在更广泛的广告业务中,我们将继续投资人工智能,我们看到我们的努力在这里得到回报。 在上个季度,广告商的转化率比去年同期高出 20% 以上。 再加上每次获取成本的下降,这带来了更高的广告支出回报。

我们也继续对商业消息传递的货币化机会感到兴奋。 Facebook 和 Instagram 是我们业务的前两大支柱,在接下来的几年里,我们希望将在线消息传递作为下一个支柱。 实现这一目标的一种方法是点击消息广告,该广告目前的运行率为 100 亿美元。

付费消息是其中的另一部分。 我们在这里的时间较早,但我们会继续让更多企业加入 WhatsApp 商业平台,他们可以在这里回答客户问题、发送更新并直接在聊天中进行销售。 例如,法国航空公司开始使用 WhatsApp 在 22 个国家以 4 种语言分享登机牌和其他航班信息。 企业经常告诉我们,与其他渠道相比,更多人在 WhatsApp 上打开他们的消息并且他们获得了更好的结果。

AI 是我们发现引擎和广告业务的基础——我们还认为它将在我们的应用程序中催生许多新产品和其他转型。 生成式 AI 是一个非常令人兴奋的新领域,有许多不同的应用,我对 Meta 的目标之一是在我们的研究基础上,除了我们在推荐 AI 方面的领先工作之外,成为生成式 AI 的领导者。

我想谈的最后一个领域是元宇宙。 我们在去年年底推出了 Quest Pro,我为此感到非常自豪。 它是第一款主流混合现实设备,我们正在通过我们的元现实系统为行业设定标准。 一如既往,我们专注于构建这些平台的原因是为了提供比当今手机上更好的社交体验。 MR 的价值在于,你可以体验 VR 的沉浸感和临场感,同时仍能置身于周围的物理世界中。 我们已经看到开发人员构建了一些令人印象深刻的新体验,例如用于 3D 建模分子和药物开发的 Nanome,用于建筑师和设计师创建室内设计的 Arkio,当然还有许多很棒的游戏。 MR 生态系统相对较新,但我认为它在未来几年内会增长很多。 今年晚些时候,我们将推出我们的下一代消费级头显,它也将具有 Meta Reality,我希望这项技术能成为未来所有头显的基线,当然最终也是 AR 眼镜也是如此。

除了 MR,更广泛的 VR 生态系统还在继续发展。 现在我们的 VR 设备上有 200 多个应用程序的收入超过 100 万美元。

我们也在继续在化身方面取得进展。 上个季度,我们刚刚在 WhatsApp 上推出了头像,已经有超过 1 亿人在该应用程序中创建了头像。 其中,大约五分之一的人使用他们的头像作为他们的 WhatsApp 个人资料照片。 我认为这是应用程序系列和元宇宙愿景如何融合在一起的一个有趣的例子。 因为即使我们 Reality Labs 的大部分投资都用于未来的计算平台——眼镜、耳机和运行它们的软件——随着技术的发展,大多数人将第一次在手机上体验虚拟世界并开始在我们的应用程序中建立他们的数字身份。

好吧,这些就是我们关注的领域:人工智能,包括我们的发现引擎、广告、商业消息传递和日益生成的人工智能,以及元宇宙的未来平台。 从运营的角度来看,我们专注于效率并继续精简公司,以便我们能够尽可能地执行这些优先事项并建立一个更好的公司,同时提高我们的业务绩效。

一如既往,我感谢我们的团队在所有这些重要领域所做的工作,并感谢你们所有人与我们一起踏上这段旅程。

内容中包含的图片若涉及版权问题,请及时与我们联系删除

评论

沙发等你来抢